html`<a style="padding: 0; margin-top: -5px;" href="${await FileAttachment("./images/Reason Explainer - Reason HB226 (2023) Summary.pdf").url()}" download>

<button>

<i class="bi bi-filetype-pdf"></i> Download One Pager

</button>

</a>`Montana Reform Improves Pension Funding and Retirement Savings for Public Employees

By Steven Gassenberger, Pension Integrity Project

Nearly two years after House Joint Resolution 8 set Montana legislators on the interim task of finding a long-term solution to better funding state pension benefits, lawmakers are advancing a reform that would greatly improve the funding and security of the state’s public employee retirement plan. House Bill 226 (HB226), sponsored by Rep. Terry Moore (R-Billings), would guarantee active and retired members of Montana’s Public Employees Retirement System (PERS) that the system’s current $2 billion of unfunded liabilities will be paid off and future debt is less likely to accrue going forward, all while also enhancing the retirement security of the majority of future public employees hired by state and local government employers.

Challenge #1: Montana’s method for funding earned PERS-DB benefits is out-of-date.

The funding risks associated with the PERS-Defined Benefit fund (PERS-DB) have been a perennial challenge for Montana. In 2001, the PERS-DB did not have any unfunded obligations. Poor investment outcomes below previous investment return expectations left today’s PERS-DB fund with the highest unfunded liabilities in the plan’s history despite a historic 29% investment return in 2021.

Source: Pension Integrity Project analysis of PERS actuarial reports and annual comprehensive financial reports (ACFR).

According to the latest reports, the PERS-DB fund is 75% funded, with just over $2 billion in unfunded pension liabilities. (See Figure 1) Investment conditions are expected to worsen—according to PERS consultants and market watchers—in large part due to volatility expected throughout the global investment markets from which nearly 60% of a fund’s growth is typically derived.

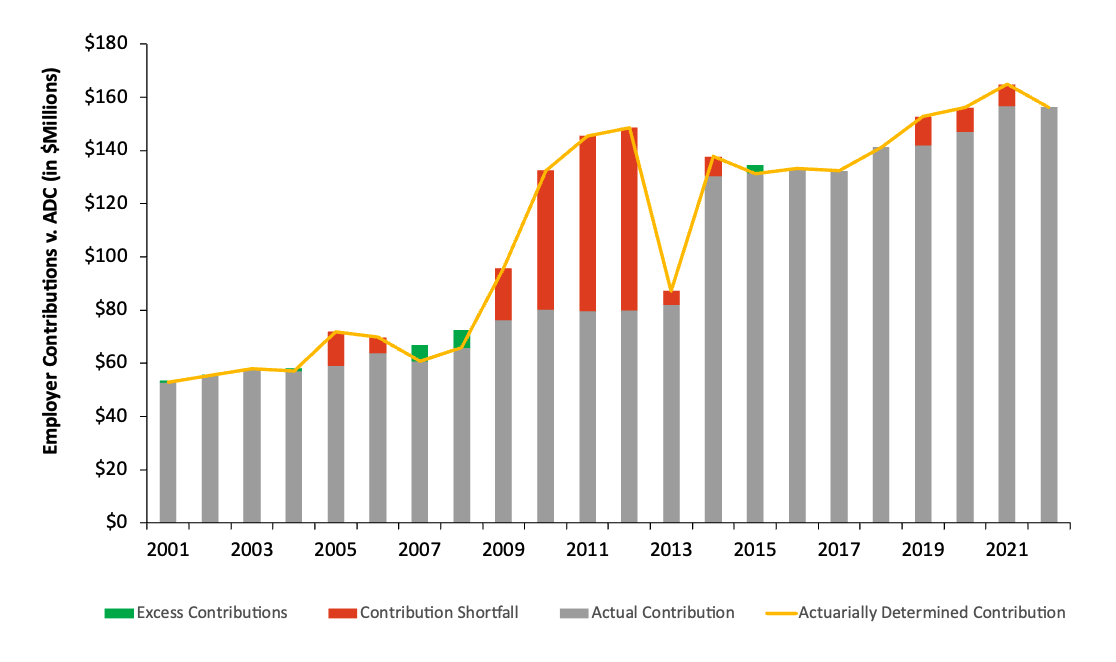

Undergirding the PERS-DB fund are contributions from public employers and participating employee members. As of the 2022 PERS valuation, members contributed 7.9% of their salaries to the PERS fund, while the state and their public employers contributed 11.58% of payroll. While the member rate has remained relatively constant over the last few decades, the employer rate has risen substantially in an attempt to start paying down the growing unfunded liabilities, and it. It is slated to rise even further over the next few years. As a result, employer contributions to PERS have frequently fallen short of the amount plan actuaries determined would be needed to reach 100% funding within 30 years (see Figure 2).

The main culprit for this misalignment between the funding needs of the PERS-DB fund and the actual contributions being made to the plan is the use of statutorily-fixed contribution rates. This means the PERS-DB employer contribution rate does not change unless the legislature acts to adjust the rate fixed in state law. Increasing the employer contribution rate in this manner is cumbersome and often too unresponsive, particularly in challenging economic times.

Figure 2: MT PERS Contributions Actuarially Required vs. Appropriateds

PERS administrators have readily acknowledged these challenges associated with the way employers contribute to the fund. According to a 2020 Legislative Fiscal Division report, “…current funding policies leave the systems [Montana’s Teachers’ Retirement System (TRS) and the Public Employees’ Retirement System] heavily reliant on investment earnings and unable to adjust contributions to maintain an actuarially sound basis in times of significant financial declines.”

When PERS actuaries use the system’s latest assumptions and experience data to calculate its value, they also determine annually how long it will take for all earned retirement benefits to be fully funded, commonly known as a system’s amortization period.

The Society of Actuaries recommends amortizing unfunded pension liabilities over a 15-to-20-year period. However, Montana’s PERS funding is based on a much longer 30-year period. The effect of a longer amortization period is a decrease in the immediate short-term costs but at the expense of much higher costs over the long term and a significant risk of prolonged underfunding from investment returns coming in below expectations. Long amortization periods, when combined with statutory contribution rates, have generated significant public pension debt, with interest on that debt heaping even more costs on Montana taxpayers.

Instead of systematically tracking inherent changes in costs, Montana historically increased its employer rate in response to growth in unfunded liabilities—usually after a long review period and a formal request from pension administrators.

This process passively allows unfunded liabilities to compound from one fiscal year to the next because the current funding policy is not immediately responsive to market conditions and pension system performance. Worse, in combination with its suboptimal funding policy, Montana PERS also uses an ineffective approach to amortizing unfunded liabilities that simply refinance unfunded liabilities each year instead of adopting a policy to pay off any new unfunded liabilities over a fixed period.

The technical term for annually refinancing your unfunded pension liabilities instead of putting them on a closed end-date path is “open amortization.” Because open amortization resets annually, it is similar to refinancing a home mortgage every year. The result of this policy in Montana has been marginal progress in eliminating unfunded obligations over the last decade.

Solution: HB 226 adopts ADEC funding to guarantee benefits are fully funded within a specified timeframe.

Since the passage of House Bill 454 (2013), Montana has consistently increased pension contributions every year to make up for unfunded pension obligations, yet the system’s funded ratio today still stands at 75%, barely higher than the 74% funded status PERS had at the time of HB454’s passage. Thus, Montana only has funding for 75% of the benefits already promised to retirees and workers. One challenge lies in correcting the system’s outdated funding policy that relies on contribution rates set in statute.

While setting contributions in statute makes annual payments predictable for government budgets, the true costs of funding taxpayer-guaranteed pensions vary over time in response to changing market conditions and investment results.

During an August 2020 hearing of the Legislative Finance Committee, PERS actuaries pointed out that “states are getting away from the old statutory funding method” and that “an actuary’s dream funding policy” is a system that adjusts “to keep up with how the plan is doing.”

HB 226 would commit state and local government employers to eliminating unfunded pension liabilities over time by adopting a funding policy requiring the use of actuarially determined employer contributions (ADEC). Moving from the current fixed-rate funding method to a method where plan actuaries annually adjust employer contribution rates as needed to respond to plan experience presents the best opportunity for policymakers to help improve the long-term cost and resiliency of the PERS-DB.

Forecasting the Impact of HB 226

Assuming all investment and demographic assumptions prove accurate over the next 30 years, Figure 3 and Figure 4 project annual retirement contributions under HB 226 compared to the current retirement system.

Under the scenario in which actual investment returns match the plan’s assumptions each year, HB 226 would increase employer contributions over the next decade but would also allow for a lower contribution in later years. Additionally, the reform would accelerate the PERS-DB’s path to full funding. Actual returns would not match plan assumptions year-to-year, however, and there is a good chance that long-term investment return results would continue to come in below the assumptions used.

The proposed reform’s true effect is most evident when investment projections deviate from the plan’s return assumptions.

Source: Pension Integrity Project modeling of Montana PERS using plan ACFR and valuation data.

Source: Pension Integrity Project modeling of Montana PERS using plan ACFR and valuation data.

Figures 5 and 6 use the Pension Integrity Project’s actuarial modeling to show how the PERS pension plan would respond to future economic recessions like those experienced during the dot.com bust of the late 1990s and the 2007-09 financial crisis. If PERS-DB experiences similar asset losses to those it did in past recessions, the system would continue to struggle with unfunded liabilities, and lawmakers and employers would remain responsible for expensive amortization payments under the status quo funding policy.

Source: Pension Integrity Project modeling of Montana PERS using plan ACFR and valuation data.

Source: Pension Integrity Project modeling of Montana PERS using plan ACFR and valuation data.

Figures 7 and 8 intensify the nature of future recessions to align with a more conservative market performance forecast. If the PERS-DB fund, under the current funding policy, experiences two intense recessions and a 6% annual rate of return over the next 30 years, the system would again continue to accrue unfunded liabilities and face additional rate increases.

Source: Pension Integrity Project modeling of Montana PERS using plan ACFR and valuation data.

Source: Pension Integrity Project modeling of Montana PERS using plan ACFR and valuation data.

Switching Montana’s pension funding policy from reactive to proactive by committing to contributions at a rate determined by plan actuaries each year leads to long-term savings and a reduced likelihood of accruing future unfunded pension liabilities. This effect spares taxpayers from having to amortize that preventable and expensive pension debt. Depending on actual market results, HB 226 could save the state between $50 million and $500 million over the next 30 years. (See Table 1)

Table 1: PERS-DB Employer All-In Cost

Source: Pension Integrity Project actuarial forecast of PERS plan. Under HB 226, the legacy unfunded liability is amortized over 30 years with a level dollar method; while new unfunded liabilities are amortized over 10 years under a layered-base, level dollar method. Years are plan’s fiscal years.

The changes proposed in HB 226 would generate significant risk reduction on behalf of Montana taxpayers. This effect is even more prominent if the system experiences economic volatility similar to the last two decades.

Challenge #2: Most employees leave too early to benefit from the current pension design.

As of the 2022 PERS valuation, a new public employee that enters the PERS-DB will see at least 7.9% of their paycheck contributed to the pension fund until they leave public employment. For those who leave within five years of being hired, the PERS-DB acts more like a temporary savings account, giving the employee back only what they themselves put into the system, plus interest, while forfeiting any employer contributions made toward their pension benefit.

According to Pension Integrity Project estimates using PERS assumptions, 70% of all new hires starting in their early twenties will find other positions outside of Montana public service within five years (see Figure 9). Only 9% of employees hired in their early twenties stay employed for the 30 years required to earn an unreduced PERS-DB retirement. The current system serves only a fraction of public employees at an ever-rising cost.

Source: Pension Integrity Project analysis based on PERS actuarial assumptions through FY 2022.

Solution: HB 226 aligns PERS to better serve the majority of public employees.

House Bill 226 recognizes the trends of the modern workforce and would shift the default benefit offered to new hires from the PERS-DB plan to the PERS-DC (defined contribution) plan while preserving choice to ensure employees can best match their retirement plan with their particular situations. This would allow for more portability and greater retirement security for the vast majority of employees hired by Montana governments, not just a relatively small group of full-career workers. The measure maintains the current PERS-DB benefit as an option for new hires who intend to serve out their careers in public employment. HB 226 would affect new hires only; active PERS-DB active members, retirees and their beneficiaries are not affected by the new, prospective default policy. (Figure 10)

Figure 10: Value Projections of PERS-DB vs PERS-DC

Based on the contribution rates proposed in HB 226, any employee, at any age, that chooses to leave their public employer within 25 years—meaning, most of the future government employees hired—would be better prepared for retirement with the proposed default PERS-DC benefit.

Fiscal Considerations

Table 2 compares the status quo with the proposed funding policy included in HB 226 from an employer cost perspective. In exchange for prudent, navigable increases in the short-term, buffed by the trust funds included in the House State Administration amendment, employers could not only expect a drop in required contribution but a complete elimination of all unfunded actuarially accrued liabilities (UAL).

Table 2: Expected PERS-DB + PERS-DC Employer Annual Contribution and Unfunded Liability

Conclusion

With HB 226, Montana lawmakers now have a direct path toward a secure and financially sustainable retirement system that better supports all of its members. Paying off unfunded pension liabilities faster results in less interest accumulated, leading to lower total costs over the long run. Adopting a sustainable funding policy and aligning the plan’s defaults with the tenure trends of the majority of public employees is a proven way to improve the long-term sustainability of PERS and attract quality public servants going forward.

Appendix

Current Structure of Montana’s Public Employee Retirement System

As currently structured, Public Employees Retirement System (PERS) offers new employees a choice between a traditional defined benefit retirement plan (PERS-DB) and a defined contribution retirement plan (PERS-DC), with the defined benefit (or pension) plan serving as the default. New employees may choose to join the PERS-DC plan at any time during their initial 12 months of employment. If no selection is made, the employee is automatically registered as a member of the PERS-DB plan. The two main differences between the PERS-DB and PERS-DC are the guarantee of lifetime benefits and the portability of an individual’s retirement savings:

- The PERS-DB offers members who work with a participating public employer for at least five years a predetermined monthly benefit check in retirement in exchange for contributions throughout their tenure in public employment. Over 53,000 active and retired beneficiaries have defaulted to, or chosen to remain in, the PERS-DB.

- The PERS-DC offers members a predetermined employer contribution toward a member’s personal retirement account, in which a member becomes vested after five years. Members can take their benefits with them upon leaving employment to do with it what they determine is best for them. Currently, about 5,000 members have elected the PERS-DC benefit option.

Each of the state’s two retirement benefit options for public employees comes with its own advantages, and both offer valuable retirement benefits to public workers. However, the current PERS structure faces two main challenges: Out-of-date funding mechanisms and a default policy that leaves most public employees without adequate retirement savings.